Venezuela is facing a socio-economic and political crisis since 2010. The situation gets worse every day with continuing inflation. The International Monetary Fund (IMF)  expects inflation to reach 1 million percentages by the end of 2018 in Venezuela. This is a condition of hyperinflation. The country faced severe problems when former President Hugo Chavez reduced poverty and brought in too many socialist policies which were a result of vast oil wealth. He changed a lot of government policies and took control of the Supreme Court. 95% of Venezuela’s export earnings come from exporting oil. The inflation rate was soared up in 2014 when the oil prices fell from $109 per barrel to $38 per barrel in 2016. As the economy was highly dependent on oil exports, the fall in oil prices led to imbalance in the economy. There was no attention given to diversify the economy or invest in domestic production other than oil sector. The country used to import basic food and medicines in exchange of exporting oil. This reminds me of the saying, “Never lay all your eggs in one basket.” In 2016, the GDP of the country dropped by 10-15% and inflation rate was as high as 800%. By the end of 2017, the country’s revenue dropped by $100 billion and it owed $150 billion to foreign creditors when it had a reserve of only $10 billion. By selling US dollars at different rates, the government effectively created a black market which led to increased corruption. Currently, the official rate is 62.63 Venezuelan Bolívar which equals to one dollar, whereas on the black market one dollar costs 273,000 Venezuelan Bolívar. With hyperinflation comes shortages and humanitarian crisis. In Venezuela, 85% basic medicines are not available, infant mortality rate is up to 65%, 87% population do not have enough money to buy necessary food items. However, hyperinflation is not a new concept and it isn’t the first time a country is experiencing this kind of price rise. Since the time of World War, there have been countries that faced hyperinflation due to reparations of war and there have been countries which faced hyperinflation in recent times as well. These countries eventually controlled hyperinflation by taking severe steps and today their economies are flourishing.

expects inflation to reach 1 million percentages by the end of 2018 in Venezuela. This is a condition of hyperinflation. The country faced severe problems when former President Hugo Chavez reduced poverty and brought in too many socialist policies which were a result of vast oil wealth. He changed a lot of government policies and took control of the Supreme Court. 95% of Venezuela’s export earnings come from exporting oil. The inflation rate was soared up in 2014 when the oil prices fell from $109 per barrel to $38 per barrel in 2016. As the economy was highly dependent on oil exports, the fall in oil prices led to imbalance in the economy. There was no attention given to diversify the economy or invest in domestic production other than oil sector. The country used to import basic food and medicines in exchange of exporting oil. This reminds me of the saying, “Never lay all your eggs in one basket.” In 2016, the GDP of the country dropped by 10-15% and inflation rate was as high as 800%. By the end of 2017, the country’s revenue dropped by $100 billion and it owed $150 billion to foreign creditors when it had a reserve of only $10 billion. By selling US dollars at different rates, the government effectively created a black market which led to increased corruption. Currently, the official rate is 62.63 Venezuelan Bolívar which equals to one dollar, whereas on the black market one dollar costs 273,000 Venezuelan Bolívar. With hyperinflation comes shortages and humanitarian crisis. In Venezuela, 85% basic medicines are not available, infant mortality rate is up to 65%, 87% population do not have enough money to buy necessary food items. However, hyperinflation is not a new concept and it isn’t the first time a country is experiencing this kind of price rise. Since the time of World War, there have been countries that faced hyperinflation due to reparations of war and there have been countries which faced hyperinflation in recent times as well. These countries eventually controlled hyperinflation by taking severe steps and today their economies are flourishing.

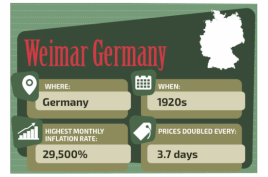

The period after the First World War, from 1918 German mark (official currency of Germany till 1990) faced hyperinflation. Germany suspended the gold standard and introduced paper mark under which the central bank issued more money without economic resources to back it up, to pay for the large costs when the First World War started and the government decided unanimously to fund the entire war by borrowing. The strategy behind borrowing was to save the domestic resources, as they expected to win the war and repay funds by annexing resource-rich countries of Europe and impose reparations on defeated countries. This strategy failed miserably as Germany was defeated in the war and the new Weimar Republic faced a huge debt from the war. This led to currency devaluation of the German Mark (exchange rate of mark against US dollar devalued from 4.2 to 7.9 per dollar) giving a start to the inflationary situation. Furthermore, the article 231 under the Treaty of Versailles which was signed in 1919, which ended the war, Germany and its allied powers accepted full responsibility of the war, Germany agreed to pay reparations to the countries affected by the war and there were territorial concessions laid on Germany. Under the territorial concessions, it lost 12% of its land majority of which were the industrial areas like Saar and Allsaice-Lorraine. In 1921, the total cost of war reparations came to a total of 132 billion marks and under the “London payment plan” it was announced that Germany will have to pay  in gold or foreign currency as the paper mark was very unstable, with an annual installment of 2 billion gold marks plus exports. After the timely payment of the first installment, Germany’s currency devalued rapidly and fell to 330 marks per dollar. In August 1921, the central bank flooded the market with printed money to buy foreign currency at any price to pay the reparations, which further lowered the value of its currency. Germany was unable to pay reparations in 1922 as the mark kept on depreciating (in January 1922, 200 marks against one dollar and rose to 8000 marks against one dollar by December 1922) due to which buying of foreign currency or gold using paper marks became almost impossible. In January 1923, the scenario worsened after French and Belgian troops occupied Ruhr, the industrial region of Germany to ensure payments of reparations. Inflation jumped to heights when Germany kept on printing additional notes to continue paying for the general strike which stopped the production of goods in Ruhr. By November 1923, one US dollar was worth 4,210,500,000,000 German marks (4200 billion German marks). Eventually a government change in Germany brought a way to end the inflation, after it had set one of its main goals of reducing debts. From 15th November 1923, the German paper mark was replaced by new currency known as the Rentenmark (currency backed by mortgages on land) and old exchange rate of 4.2 rentenmark against one US dollar was set. On the international platform, Dawes plan was signed in August 1924 Ruhr area was given back to Germany which had partially caused the hyperinflation and German reparation payments were adjusted according to its economic ability. Following these changes German economy started to recover from the inflationary situation.

in gold or foreign currency as the paper mark was very unstable, with an annual installment of 2 billion gold marks plus exports. After the timely payment of the first installment, Germany’s currency devalued rapidly and fell to 330 marks per dollar. In August 1921, the central bank flooded the market with printed money to buy foreign currency at any price to pay the reparations, which further lowered the value of its currency. Germany was unable to pay reparations in 1922 as the mark kept on depreciating (in January 1922, 200 marks against one dollar and rose to 8000 marks against one dollar by December 1922) due to which buying of foreign currency or gold using paper marks became almost impossible. In January 1923, the scenario worsened after French and Belgian troops occupied Ruhr, the industrial region of Germany to ensure payments of reparations. Inflation jumped to heights when Germany kept on printing additional notes to continue paying for the general strike which stopped the production of goods in Ruhr. By November 1923, one US dollar was worth 4,210,500,000,000 German marks (4200 billion German marks). Eventually a government change in Germany brought a way to end the inflation, after it had set one of its main goals of reducing debts. From 15th November 1923, the German paper mark was replaced by new currency known as the Rentenmark (currency backed by mortgages on land) and old exchange rate of 4.2 rentenmark against one US dollar was set. On the international platform, Dawes plan was signed in August 1924 Ruhr area was given back to Germany which had partially caused the hyperinflation and German reparation payments were adjusted according to its economic ability. Following these changes German economy started to recover from the inflationary situation.

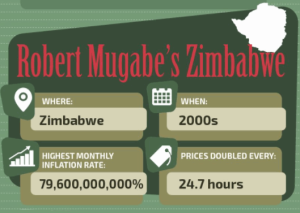

After Zimbabwe got independence (in April 1980) from South Rhodesian colony, the new government abandoned the use of Rhodesian dollar and brought the rule of using only Zimbabwean dollar whose value was kept at par with Rhodesian dollar. The inflation in Zimbabwe began from the late 90s when the government instituted land reforms in a way that the white landowners were evicted and their lands were given to the black farmers. The problem started when many of the new farmers had no experience or training in farming resulting into a sharp decline in the food production (output). The banking sector failed as the farmers were unable to get loans for capital development. The scenario worsened by the year 2006-07 when food production output dropped by 45%, manufacturing by 29% and unemployment rose to nearly 80% in the country. Zimbabwe was one of the largest exporters of food items like maize, tobacco etc to South Africa and many other countries but with a decline in production the exports also dropped leading to lessening the revenue. Under this situation the Central bank of Zimbabwe started printing additional money which further devalued their currency (Zimbabwean Dollar), this increased printing of money started to finance the Second war of Congo. Due to a declining economy the government (national) debt increased. To deal  with higher debts, the government again increased the rate at which they printed the money; also introduced higher denomination notes upto 100 trillion, resulting into higher inflation. Due to the decline in output, there were shortages of goods, which made basic necessities more expensive. Nominal demand was rising because people had more paper money. This combination of more money chasing fewer goods caused very rapid rises in price. When there is a shortage – prices rise. Combined with printing more money and this shortage of actual goods, prices rose rapidly. This decreased the value of Zimbabwean dollar instantly. When the official market failed, the black market became more and more significant for e.g. a loaf of bread would cost around Z$ 550 billion in the official market whereas in the black market the same loaf of bread would cost Z$ 10 billion. The black market kind of became the only option for citizens. As this condition continued in 2008, Zimbabwean hyperinflation rate peaked at 79,600,000,000% in November during which one dollar equaled more than 2 billion Zimbabwean dollar ($1= Z$ 2,621,984,228). In January 2009, the government lifted the ban on using other foreign currencies, which was used illegally before. They also restricted the amount of cash withdrawals from banks to limit the amount of money in circulation. An effective solution to hyperinflation came when Zimbabwe changed its official currency from Zimbabwean dollar to the US dollar in 2009, which stabilized the general consumer prices. It also stopped printing the Zimbabwean dollar in 2009. In June 2015, the central bank demonetized the Zimbabwean dollar to get a complete switch to the US dollars by end of September 2015. The economy took some years to recover from the effects of hyperinflation but as of July 2018 the inflation rate of the country is 4.3%.

with higher debts, the government again increased the rate at which they printed the money; also introduced higher denomination notes upto 100 trillion, resulting into higher inflation. Due to the decline in output, there were shortages of goods, which made basic necessities more expensive. Nominal demand was rising because people had more paper money. This combination of more money chasing fewer goods caused very rapid rises in price. When there is a shortage – prices rise. Combined with printing more money and this shortage of actual goods, prices rose rapidly. This decreased the value of Zimbabwean dollar instantly. When the official market failed, the black market became more and more significant for e.g. a loaf of bread would cost around Z$ 550 billion in the official market whereas in the black market the same loaf of bread would cost Z$ 10 billion. The black market kind of became the only option for citizens. As this condition continued in 2008, Zimbabwean hyperinflation rate peaked at 79,600,000,000% in November during which one dollar equaled more than 2 billion Zimbabwean dollar ($1= Z$ 2,621,984,228). In January 2009, the government lifted the ban on using other foreign currencies, which was used illegally before. They also restricted the amount of cash withdrawals from banks to limit the amount of money in circulation. An effective solution to hyperinflation came when Zimbabwe changed its official currency from Zimbabwean dollar to the US dollar in 2009, which stabilized the general consumer prices. It also stopped printing the Zimbabwean dollar in 2009. In June 2015, the central bank demonetized the Zimbabwean dollar to get a complete switch to the US dollars by end of September 2015. The economy took some years to recover from the effects of hyperinflation but as of July 2018 the inflation rate of the country is 4.3%.

Venezuelan economy can possibly adapt these measures from Zimbabwe, Germany and other countries which have faced hyperinflation in the past. One measure that was taken in both the countries, Zimbabwe and Germany was a change in official currency. However, Venezuela has already tried that measure when they introduced the sovereign Bolívar which stripped off five zeroes from the original currency strong Bolívar in August 2018, but many economic analysts believe that this change in currency has further confused the workers and business owners due to which the situation has worsened. Also this hasn’t yet rectified the country’s main issue due to which the hyperinflation continue which are decrease dependency on oil revenues and financing to restructuring the debt. However, Zimbabwe faced similar issues and changed its official currency to a stable currency like the US dollar. In my opinion, this is the kind of measure that might help Venezuela because it will be able to stabilize the prices of consumer goods which can further stabilize the economy. Also, Venezuela is currently looking to shift to a crypto currency “Petro” which is already linked with its current currency which is backed by oil resources of the country, in my opinion this might further inflate the economy more because the oil industry of Venezuela is very vulnerable to external sources like the other OPEC countries. International countries think a military intervention is required to stabilize the Venezuelan economy which I think will further accelerate the humanitarian crisis leading to a deteriorating the economy. In my opinion a change of government can also restore the situation in Venezuela since there is almost no confidence in the current government both nationally and internationally. Many would argue that Maduro has been re-elected recently, but looking at the scenario in Venezuela and the kind of power that rests in the hands of president of Venezuela it might not be a fair election. Also only 46% of the population showed up for the election and many national and international organisations have showed concerns about irregularities in the elections.

Leave a comment